The Rivers Cole and Blythe in and around Solihull are ‘threatening to burst their banks’ according to the Birmingham Mail. Solihull Lodge was said to be at risk as the Cole rose to more than half a metre above its usual level on Sunday morning. ‘Aspirational’ housing was recently built above this regularly flooded area.

Some councils are not yet changing their approach to planning applications for houses to be built above or in traditionally flood affected areas, often approved despite warnings from local residents and councillors.

An FT report published yesterday estimates that one new home in every 14 built in 2013-14 — the most recent year for which data is available — was constructed on land that has a significant chance of flooding, either from a river or the sea.

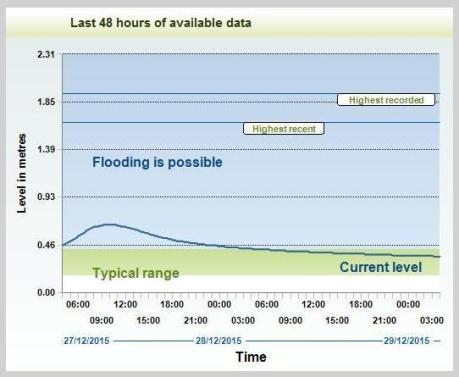

Solihull Lodge residents who saved the Environment Agency link to their area – current version above – will be able to monitor the situation, but those living elsewhere will find it difficult, perhaps impossible, to navigate the EA’s website. Areas like Selly Park and Stirchley need this information in easily accessible form.

Birmingham Resilience offers help

- 1% of residents have signed up to receive warnings by phone, text or email from an automated flood warning gauge which records the water level every 15 minutes. This will give them time to move their family, pets and possessions to safety. Read on here, scrolling down.

- People who live in a Birmingham area at risk of flooding and would like to set up a flood action group can be referred to the flood group co-ordinator. Resident groups have been set up in Witton, Selly Park South, Rea Valley and Frankley.

https://www.youtube.com/watch?v=riosZ3V8_48: Skinny’s Videos – Floods in Greater Stirchley, 2008

https://www.youtube.com/watch?v=riosZ3V8_48: Skinny’s Videos – Floods in Greater Stirchley, 2008

Residents confirm The Stirchley News report that Severn Trent solved the flooding problems in Dogpool Lane earlier this year.

Severn Trent Programme engineer Claudia Sequeira explained that £3 million has been invested to install a kilometre of new, bigger sewer pipes and two large underground storage tanks in the Cartland Road area to store rain water, which will help to prevent sewer flooding. Storage tanks had also been built next to Pershore Road and Ripple Road, new sewers installed in Newlands Road, Ripple Road and Cartland Road and connected to the existing network.

In 2013, government negotiated an agreement with the Association of British Insurers, to give cover to all private housing and cap flood insurance premiums

All UK household insurers were to pay into a pool, creating a fund that can be used to pay claims for people in high-risk homes. The flood insurance premiums would be linked to council tax bands so that people will know the maximum they will have to pay. Implementation has been delayed and will not be in force until April 2016, however, and the process is far from transparent; insurance companies have different ways of assessing insurance costs:

- some offer their own products.

- some rely on the Environment Agency’s assessment and

- some follow the rulings of the Association of British Insurers.

The Federation of Small Businesses will continue to press government to offer SMEs cover under the government’s flood programme, Flood Re

Smaller businesses will be excluded from the programme, which guarantees affordable insurance to domestic properties, except for rentals; landlords are not eligible, so tenants in flooded properties face the prospect of being removed.

Yesterday the Financial Times reported the FSB’s estimate that about 75,000 smaller businesses at risk of flooding had found it difficult to find flood insurance and 50,000 had been refused cover nationally.

Accountants – KPMG [Press Reader] and PwC [BBC] – have warned that thousands of businesses will face financial ruin because they will have to bear a fifth of the estimated £5bn national cost of flood damage, with inadequate or non-existent insurance cover.

John Allan, the FSB’s National Chairman, said: “Ministers should look again at the availability of affordable and comprehensive flood insurance for small businesses, potentially through a dedicated Flood Re style agreement. The financial cost to small businesses following the 2012 flooding was £200 million.

“We can’t hope to create a buoyant economy . . . if vulnerable small businesses can’t sufficiently protect themselves from increasingly unpredictable and severe weather that in the worst cases can close a business.”

–

[…] https://ourbirmingham.wordpress.com/2015/12/29/governments-unfulfilled-2013-flood-insurance-promise-… […]